This is a guest post from Shane Morgan, Partner within the Medical Division at Cutcher & Neale Accounting & Financial Services. Shane recently spoke at the 2017 AAPM Conference and has extensive experience assisting practitioners in planning and structuring their businesses plus improving financial performance.

Thinking of taking the ‘Big Leap’? Here’s what you need to consider before opening, or buying into, a medical practice.

Owning your practice is the dream for many practitioners, however it is certainly not to be taken lightly.

You are essentially entering a second marriage. All aspects of the clinical and financial implications should be considered before making any binding arrangements.

It is crucial to get the financial aspects of your practice right from the outset to avoid becoming unstuck later down the track.

Below is an outline of some key factors to keep in mind.

Business Structuring and Asset Protection

How will you structure the setup? For example, there are various structures that practitioners operate through, such as Sole Trader, through a Company, or a Trust Structure.

All have differing characteristics in the following areas:

- Complexity

- Applicable tax rates

- Control

- Limited liability

- Asset protection

- Ongoing costs

- Specific legislation

Operating from a poorly structured practice can lead to issues such as:

- Tax inefficiency for doctors

- Liability for payroll and other taxes – we often see this mistake made in practice due to poor documentation of the grey area of employee vs contractor doctors

- Compromised asset protection – take the ownership of the practice premises as an example. It may be tax effective to have the building owned in the doctors’ name, however this may also increase the risk to asset protection.

- Difficulty in valuation (a problem when looking to sell)

Funding the Purchase

- Have you considered how you will obtain finance for the purchase, as well as the setup of equipment for the practice?

- You should consider tax deductible debt strategies which can add up over the long term.

Due Diligence

When purchasing a practice, have you considered at least 3 years of financial information?

Although it is very important to note, that financial information alone will not tell you the value in a practice purchase price.

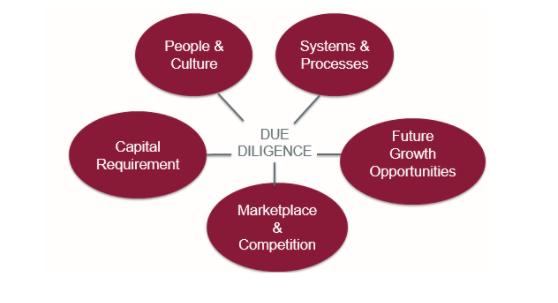

There are also crucial non-financial components that must be reviewed:

- Business name – has this been registered?

- Is there a presence on the internet or social media?

- Is the practice premises owned by a third party that you have no influence on – meaning could you be forced to move when the lease ends?

- Do you know the key staff members such as the Practice Manager – are they likely to stay with you upon purchase?

I have outlined some of the non-financial considerations below.

Insurance

- Have you considered options for both business and personal insurance?

- Do you have current policy structures in place that need to be reassessed?

The Power of Superannuation when Renting / Buying your Practice

- Have you considered the benefits of owning the surgery within your SMSF?

- Is it time you reassessed your current structure to get the most out of your fund?

Key Performance Indicators and Benchmarking

Once you have made the purchase, it is crucial that you can track your performance against your goals and your peers.

In the next blog in this series, we will tackle Practice Key Performance Indicators and Benchmarking.